File HVUT 2290 Online Quickly and Securely

Get your Heavy Highway Vehicle Use Tax done Right Away & Get Schedule 1 in minutes.

We are now accepting IRS Form 2290 for the 2023-2024 Tax Year!

File Form 2290 Now

Due Date For Filing HVUT 2290

The IRS Form 2290 needs to be filed annually by 31st August for each of the taxable vehicles used on the public highway during the current tax period. The current tax period for heavy vehicles starts on July 1, 2023, and ends on June 30, 2023. You need to File HVUT 2290 once the vehicle is placed in service. The due date for each month will be the last day of the following month.

Visit https://www.expresstrucktax.com/hvut/irs-form-2290-due-date/ to know more about the Due date for HVUT filing.

Features we provide for filing Hvut 2290:

GUARANTEED SCHEDULE 1 OR YOUR MONEY BACK

After Filing HVUT 2290 Form You will be receiving Guaranteed Schedule 1 from IRS or Money back.

Free VIN Corrections

If you entered the wrong VIN number while filing your Heavy Highway Vehicle Use Tax, you can e-file a free VIN correction to correct it.

RECEIVE STAMPED SCHEDULE 1 IN MINUTES

Yes, you can receive your Stamped Schedule 1 in minutes once your Heavy Highway Vehicle Use Tax form is filed and approved for the current tax year.

IRS Authorized

Since we are one of the IRS authorized service providers, you know very well that you are in good hands. We will make sure that when you File HVUT online your return will be transmitted securely and safely.

Bulk Upload

Do you have multiple trucks to file for? Don’t worry! You can save a huge amount of time using our bulk upload feature which accepts about 40,000 trucks at a single instance.

Instant Error Check

We will easily scan your return to ensure that you are submitting the return to the IRS free of any errors. So, this way you can be sure that the Form 2290 isn’t rejected by the IRS.

Information Required to File HVUT Form 2290

Below mentioned are the Information Required to File HVUT Form 2290

- Employee Identification Number (EIN), Name & Address of the Business

- First used Month (FUM), Vehicle Identification Number (VIN), Taxable Gross Weight Category and Suspended Vehicle(if any) are the Vehicle Information that should be provided.

Click here to know more about Form 2290 instructions.

Steps to E-File HVUT 2290

Here are the steps to E-File HVUT 2290 & Receive Stamped Schedule 1

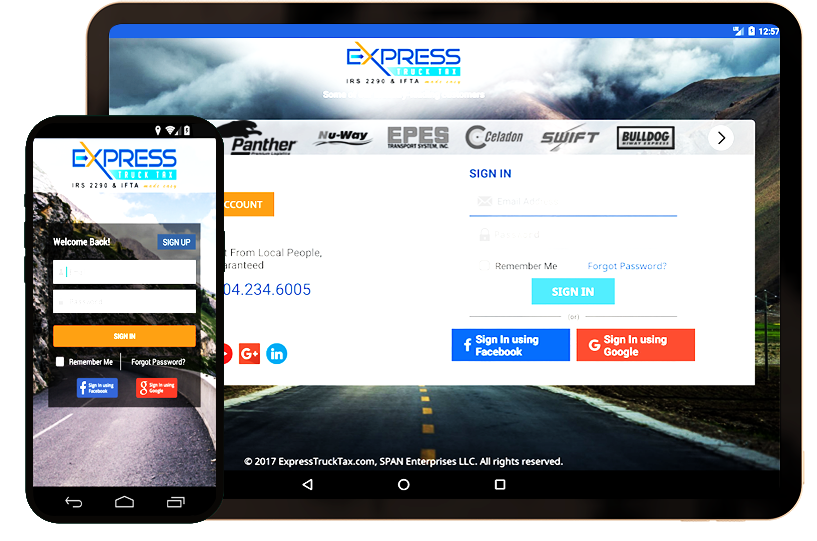

- Create an Account

- Add Business Details

- Select the tax year and the first used month

- Add the Vehicle Information

- Choose the payment method

- Transmit to IRS and receive Schedule 1